Get all your small and business accounting tasks handled by our experts.

Now play your business on the pitch for modern accounting and computing technology.

Every business deserves better accounting, computing and bookkeeping technology. You also deserve the same. Our accounting and computing system is developed with so many advanced tools, features and functions that make your accounting work highly accurate and precise. Our on-time delivery of services gives your business a push towards success.

We are now available with Online Accounting Solutions and Cloud-based Accounting Solutions

Just ask yourself only!

What do you think which type of business progress? The one that gets work from experts or the one that takes the pain of the work on itself!

Now that you also know which type of company tastes successful. Exponentially, only those businesses rise whose core focus is on doing business only. Every business knows and takes care of so many accounting and administrative tasks. Out of which, we are here to perform all your accounting tasks on your behalf so that you can keep proper attention on your business and other administrative tasks.

Why Businessaccountings Only

When It Comes To Outsourcing?

Paramount of Success

Get a wide range of accounting and computing services with a direct access to business accountings’experts so that all your doubts can be entertained in real-time. Our aim is to ensure your success in your industry.

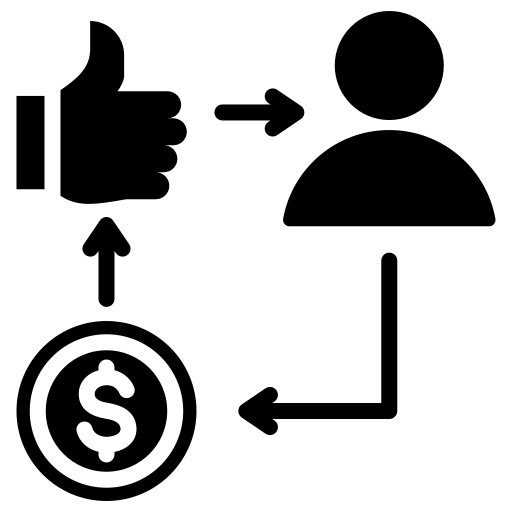

A Flow of Your Business

Lack of resources and time jointly work towards not building a better flow in your business. But you can outsource it to us so that you can keep a proper focus on your business and maintain flow.

Value for Money

Our tailor-made services are designed as per your requirement. That’s why we always say that we have limited as well as comprehensive services. You can also opt for online and cloud-based accounting services.

Save Time & Ensure Accuracy

There are three main reasons behind outsourcing your accounting tasks to us. It saves time and money, no need to hire professionals, connect with the expert team of professionals anytime.

Other Salient Features Of Businessaccountings

Get all your accounting and bookkeeping process handled by in-house team of professionals.

Keep a proper track of all your tasks with proper compliance & accounting restructuring

We also help our customers/clients gain accounting knowledge as and when required.

We have a 24/7 advanced support team available to provide you with complete support.